1. Plan It.

Start with what matters most to you — a goal, a budget, or a wallet.

Whether you’re working toward something big, trying to organize your spending, or just setting aside some money — getting started is simple.

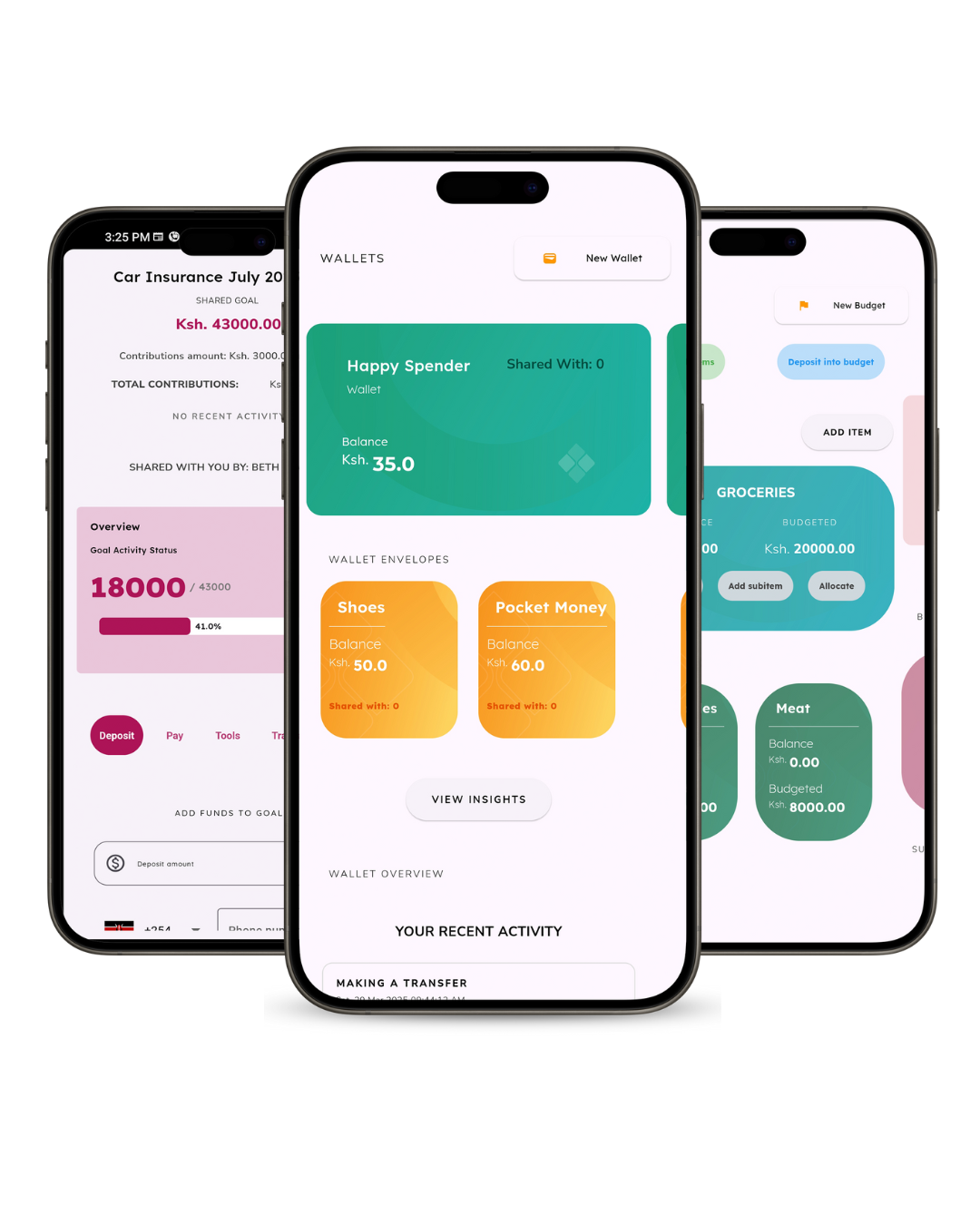

- Create a wallet and fund it — then divide your money into envelopes for different needs.

- Set up a budget and break it down into items and sub-items that reflect your real life.

- Start with a goal, define your target, and save toward it — step by step.

However you start, you’re already one step ahead.

2. Spend it.

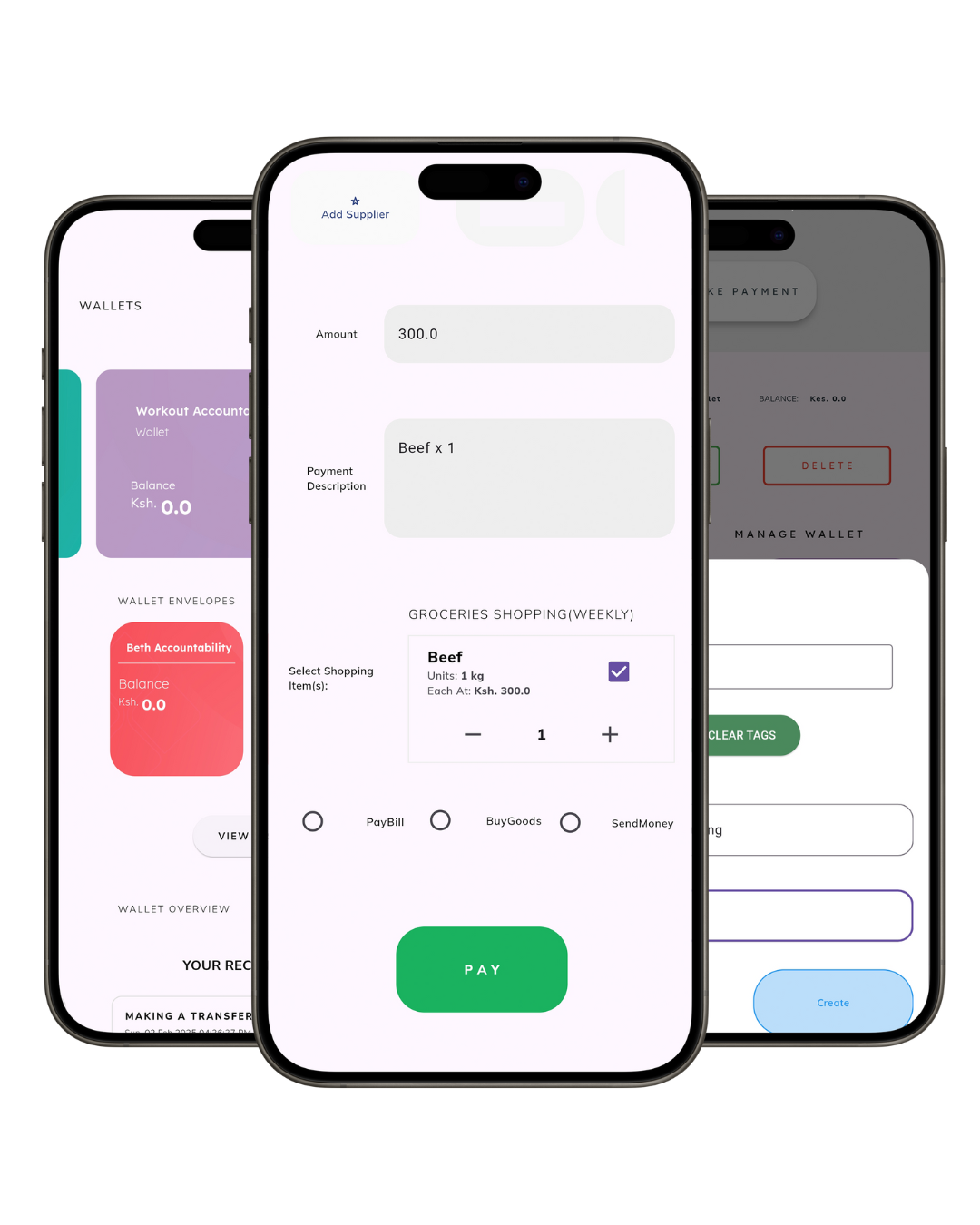

Spend straight from your plan — no mental math, no guesswork.

Every shilling has a job when you spend from your wallet, envelope, or budget.

- Use your wallet and envelopes to cover daily needs — and stay within limits for things like food, bills, or fun.

- Track budget items automatically so you always know what’s been used and what’s still available.

- Collaborate with others — share wallets or spending categories with your partner, family, or team so everyone stays on the same page.

Spend with confidence, not confusion — together or solo.

3. Save it.

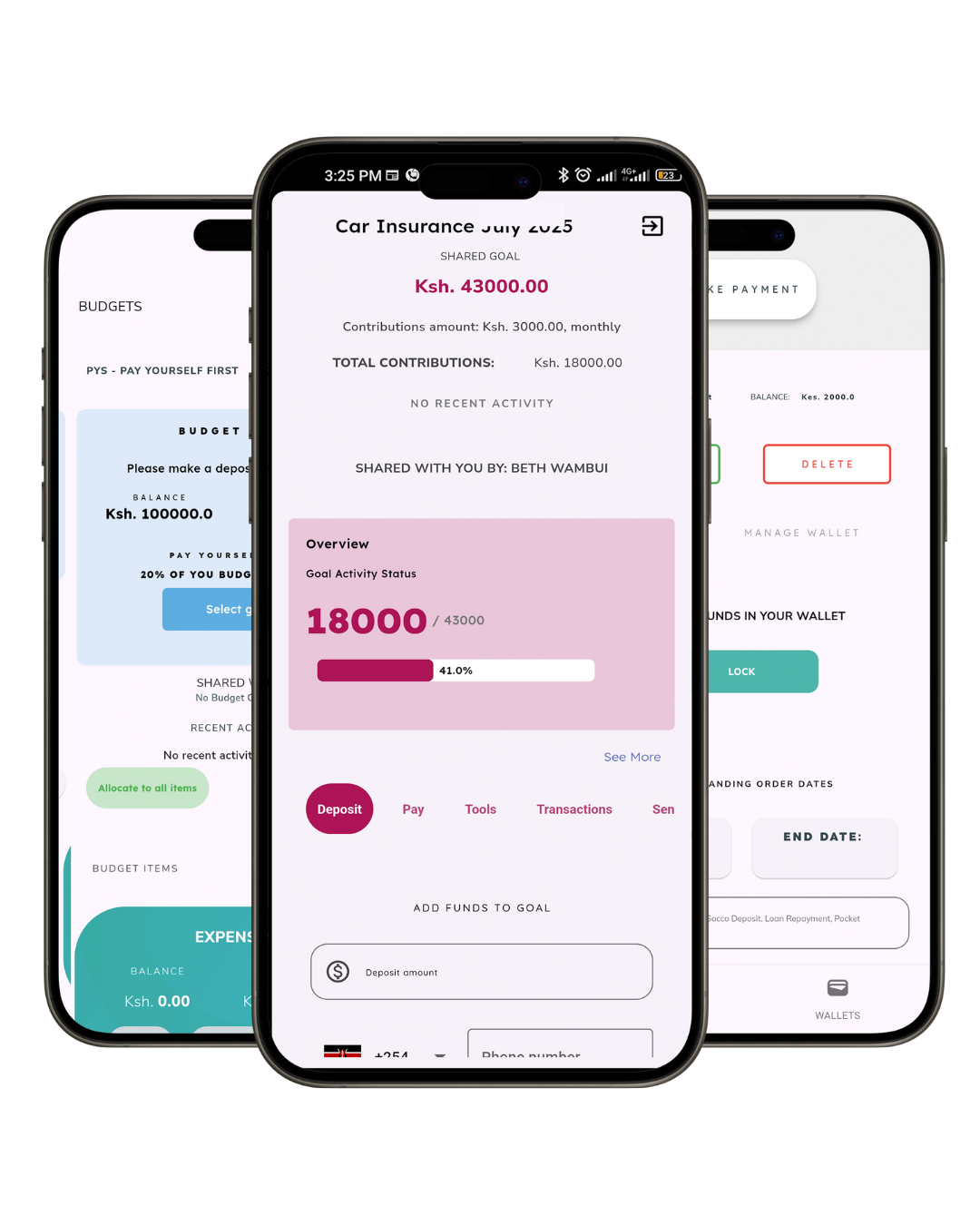

Save with intention — not pressure.

Whether it’s something big or just peace of mind, Flexiwallets makes saving part of your flow.

- Create a goal, set your target, and watch your progress grow with every contribution.

- Save from your wallets or budgets — manually or automatically — based on what you already set aside.

- Collaborate on shared goals — whether it’s a family emergency fund or a weekend getaway with friends.

It’s saving that fits your life — not the other way around.

Get Started Today!

Create a personal account today

Create a business account today